EDF Staff | June 18, 2013

By Tom Murray

Hats off to the World Wildlife Fund and CDP for an important new study, released this week, about the potential to drive significant financial benefits, higher return on investment, and increased capital expenditure by pursuing a goal to reduce carbon emissions by 3% annually across the U.S. corporate sector.

The new report shines a spotlight on the value of challenging the private sector to address climate change and boost the bottom line, rather than seeing them as opposing goals.

In my new role as Vice President, Corporate Partnerships, our division that works with leading companies, I encounter countless examples of the power of strategic environmental management to create business value. That’s why the findings of the 3% solution study resonate with me. Here are three key takeaways:

1. Companies that set aggressive carbon reduction targets trigger a cascade of positive results, including large emissions reductions, high financial returns, innovation, and a greater level of engagement. EDF has seen this with many of our corporate partners.

• Walmart set a very public emission reduction commitment of 20 million metric tons by 2015, a goal that has cascaded through the entire supply chain and throughout the organization.

• EDF helped FedEx achieve an ambitious fleet efficiency improvement goal of 20% by 2020 by launching a fleet of street-ready hybrid trucks. This move catalyzed an industry revolution of new hybrid vehicles now used by some of the biggest brands in the country.

• AT&T set a public Energy Policy signed by the CEO and supported throughout the organization; one key result was $86 million in annualized savings from 8,700 projects implemented in 2010 and 2011.

In all three cases, our corporate partners achieved significant emission reductions, but also saw returns in the form of bottom-line savings, organizational buy-in and engagement, and new technological innovations..

2. Energy management is a strategic, profitable endeavor. The study reports that 4 out of 5 companies surveyed saw "higher returns on investments aimed specifically at reducing carbon emissions than on their overall portfolios." This finding supports a fundamental rethink of energy management from a way to shave operating costs at the margins to a strategic priority, on an equal footing with any other investment decision the company makes.

• EDF sees this repeatedly through our work with EDF Climate Corps. Companies willing to make a small summer investment in our trained graduate students have seen, on average, $1 million in energy savings.

• One of our EDF Climate Corps alumni went on to work at adidas, setting up the company's “greenENERGY fund.” This investment fund is forecast to deliver a 36% return on investment after 7 months; this is in addition to reducing carbon use by 1,401 metric tons.

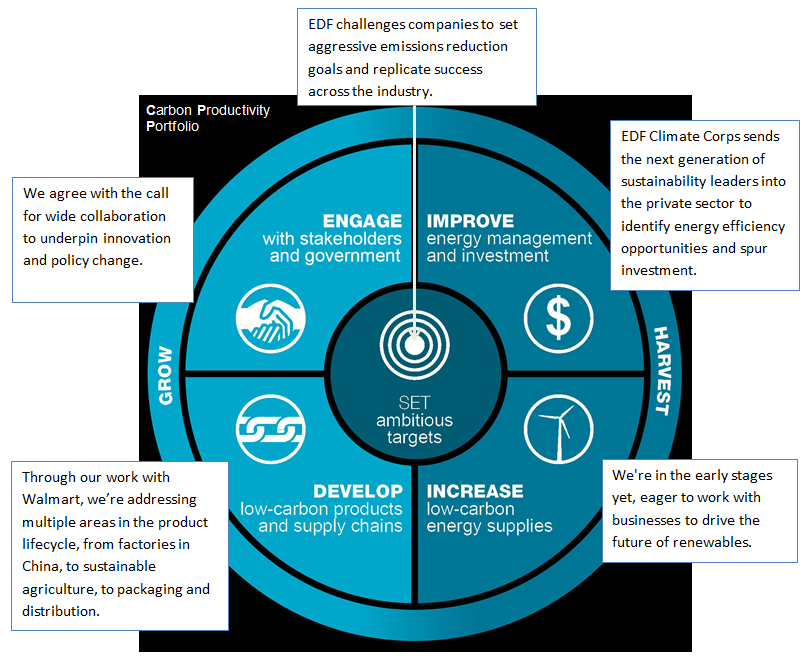

3. Companies need to take a systemic approach to cutting carbon emissions. We couldn't agree more. The report's Carbon Productivity Portfolio shares much with EDF's multi-part approach.

In the coming months, we’ll be taking a deeper dive into how we are challenging our corporate partners to adopt a systematic approach to energy and environmental management.

In the meantime, we welcome your views on the 3% Solution as well!